Transforming a fragmented legacy flow into a clear, reliable financial experience.

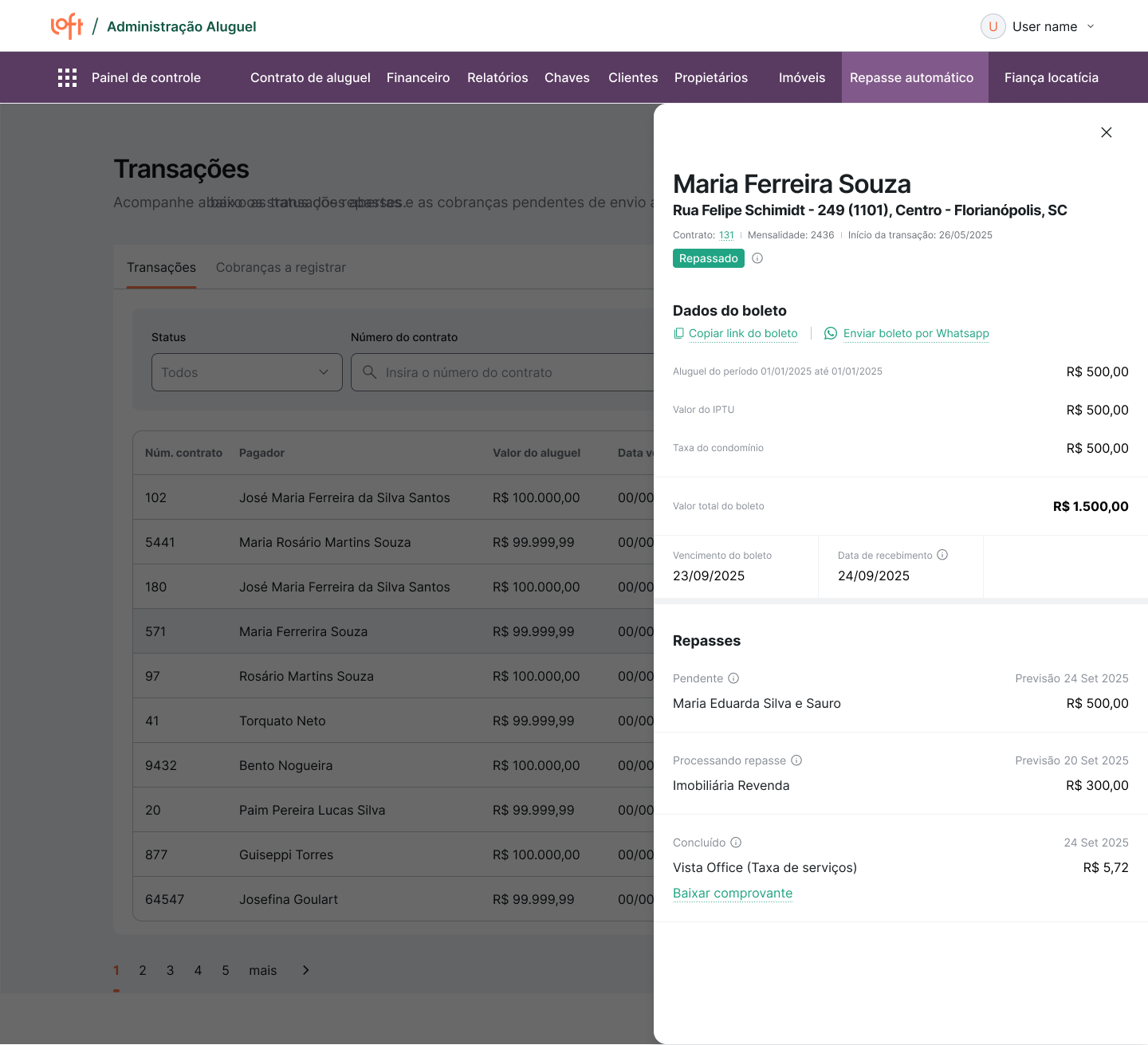

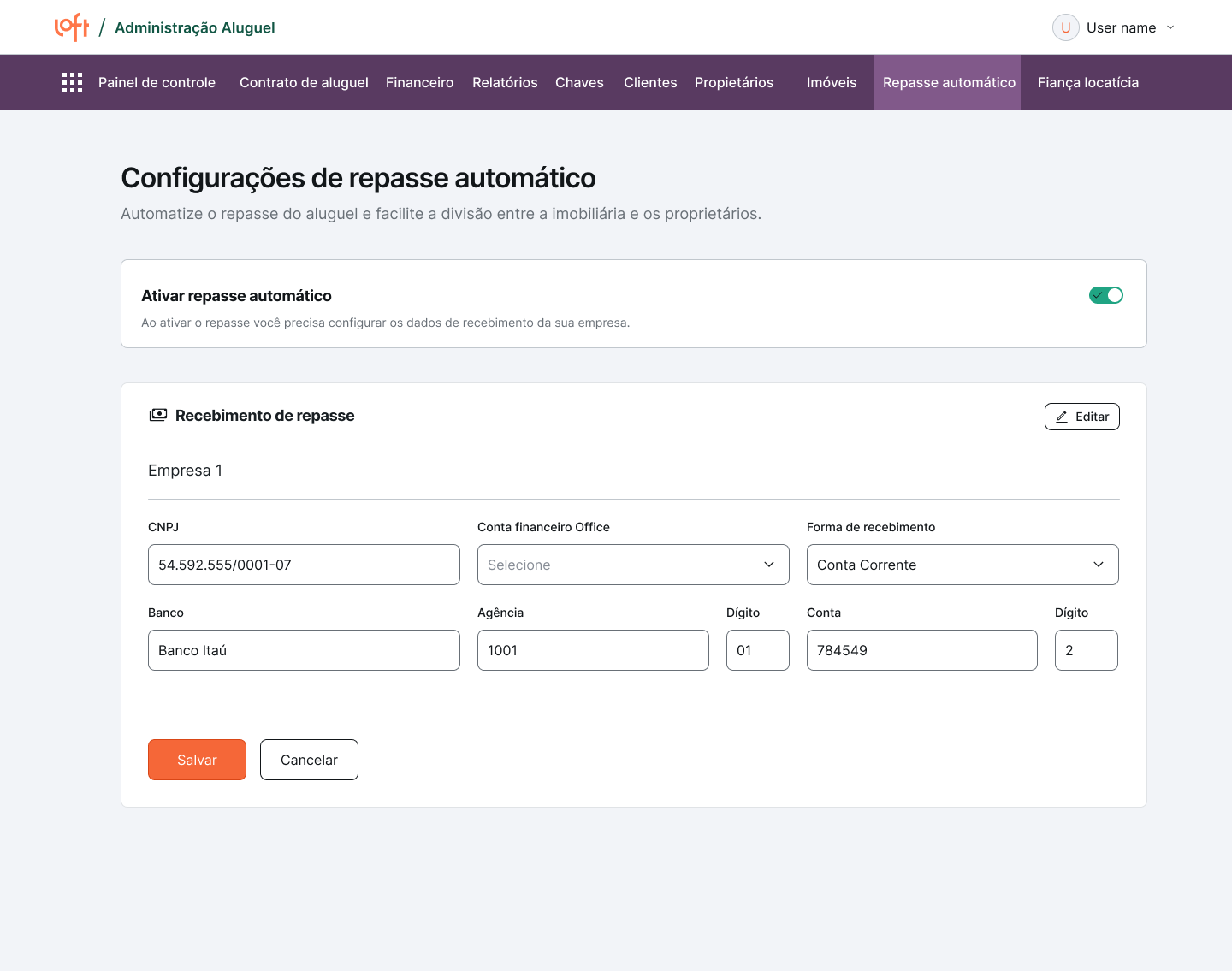

This project showcases the redesign of the Property Payout flow within a legacy ERP used by real estate agencies. I streamlined the fragmented journey into a clear, scalable end-to-end experience and delivered a consistent UI using the updated design system.

The new workflow now supports contract rules, banking setup, and payout monitoring — driving adoption across dozens of agencies and significantly increasing TPV.

1. Overview

The Property Payout Platform is a core module inside a large legacy ERP used by real estate agencies for rental management. Before the redesign, the payout experience was fragmented across multiple screens, relied on outdated UI patterns, and produced frequent configuration errors. This created operational friction for agencies and limited the company’s ability to scale and monitor TPV through payouts.

This project focuses on modernizing the entire payout experience — from contract setup to daily transaction monitoring — using the updated design system and a scalable platform approach.

My role

I led discovery, UX mapping, UI design, and design system extensions, collaborating with engineering through implementation and post-launch iteration.

2. The challenge

The previous payout flow had three structural problems:

Fragmentation: Key setup steps were hidden across multiple sections of the ERP, causing misconfigurations.

Lack of hierarchy and clarity: Financial data, statuses, and rules were displayed inconsistently, which led to user errors.

System limitations: Legacy screens prevented agencies from configuring contracts or payout rules with accuracy and confidence.

Users often contacted support because they didn’t understand the payout logic, rule priorities, or status messages, slowing activation and reducing trust in the product.

3. Discovery, Insights & Solution

I mapped the legacy workflow, interviewed implementation teams, and analyzed adoption patterns to uncover the core issues: fragmented configuration steps, inconsistent hierarchy for financial data, missing design system patterns, and onboarding gaps that led to recurring setup errors. These insights shaped a unified end-to-end model for configuring payout rules, banking details, and transaction visibility.

The redesigned experience consolidates everything into a clear and predictable flow. I applied and extended the design system with new components for payout rules, transaction states, and banking validation, while establishing consistent structures for financial summaries and contract details. I partnered closely with engineering to validate constraints and refine interactions, and after launch, iterated on labels, navigation, and error states based on feedback from agencies and support teams.

4. Deliver, iterate and results

I delivered a full end-to-end specification with interaction states, validation rules, and component documentation, collaborating closely with engineering to refine behaviors and ensure alignment with the design system. After release, I monitored adoption and gathered feedback from agencies and support teams, iterating on labels, statuses, and navigation to improve clarity.

These improvements reduced setup errors and increased user confidence. The payout platform quickly scaled to R$ 1.97MM in monthly TPV, 50 active agencies, and 1.33k rental contracts. Adoption grew consistently: +260% activated agencies, +250% trust in the module, and +180% TPV growth in the initial rollout.